Post

How can we help London’s life sciences sector to keep growing?

7 Oct 2024

In a recent article for OnLondon, Society Trustee Dave Hill reflected on the growing life sciences sector and what it means for the changing shape of London. This followed on from a recent event that was kindly hosted by Allies and Morrison architects in their office. We hope you enjoy this piece and please consider signing up for all the news on the OnLondon website.

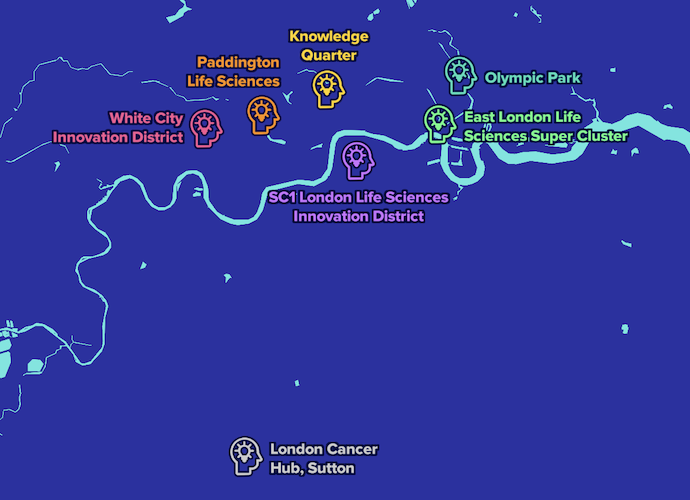

The map is a good place to start. Provided by MedCity, an organisation dedicated to boosting the capital’s trailblazing exploits in working out how to make living things healthier, it shows us the locations of London’s clusters of “life science” endeavour – what MedCity chief executive Angela Kukula described at a recent London Society event as the city’s seven “innovation districts” in this field.

Most of them are fairly central and have a top-flight academic institution at their heart. In the west, the White City and Paddington districts include Imperial College facilities. The Knowledge Quarter in and around Bloomsbury is the long-standing first home of University College London (UCL).

Just south of the river, the SC1 district brings King’s College together with Guy’s and St Thomas’s hospitals and with “innovation hubs” variously focused on medical and biomedical technology, neuroscience and mental health. Further east, find Canary Wharf’s growing “super cluster” and a while new UCL campus on the Olympic Park.

And, pleasingly for fans of polycentrism, the life sciences reach now extends to Sutton, where the London Cancer Hub is to grow on a site next to the Royal Marsden hospital and the Institute for Cancer Research.

The sector is already flourishing. Kukula told her audience at the Southwark office of architects Allies and Morrison that 22 London universities in all have “some sort of course in life science or healthcare” collectively being taken up by about 75,000 students each year.

Around 2,500 life science companies are based in Greater London, and some 90 spin-offs or start-ups appearing annually. The sector as a whole employs 31,000 people and rising by 14 per cent per annum. Kukula said that London has “the highest concentration of pharmaceutical research and development locations in Europe” .

And why wouldn’t it? After all, London contains all the ingredients required for such success: top university research and specialist hospitals, such as the Marsden, Great Ormond Street and Moorfields, a unique national health service, an advanced financial ecosystem and proximity to policymakers, all of which strengthen its attraction for talent from around the country and the world. It is a product of agglomeration in action. How can this strength be made stronger still?

Part of the answer is more buildings, but they need to serve precise requirements. “A lot of the equipment is quite heavy,” said Kukula, mentioned vast, vibrating centrifuges and other things so big they have to assembled within buildings rather than delivered and fitted – MRI scanners, electron microscopes. water and power consumption levels are high.

Rooms need to be taller, the better to provide ventilation in environments where gases, and, at times, unpleasant smells have to be dealt with. Seriously dark and ultra-clean rooms may be needed. The chemical being used and diseases being tackled can be deadly. Regular office spaces just won’t do.

In recent years, developers have made strides towards meeting demand. A few years back, by MedCity’s calculations, there was unmet demand for 500,000 square feet of lab space. That has now been halved and more is in the pipeline, but “right now it’s almost a case of it you build it they will come”. Significant newcomers include the Tribeca building at the Francis Crick Institute in Camden and Paper Yard at Canada Water. An extension to the British Library is proposed too.

Currently, London trails only Boston and San Francisco is terms of life sciences capability, as measured by MedCity. “What we would like is for London to be the global city of choice,” Kukula said, emphasising too the desirability of international collaboration on research. A “London offer” for life sciences has just been launched in the hope of attracting more talent, more investment and, of course, more breakthroughs.

It is hoped that 80,000 new life sciences jobs will appear in London over the next ten years, something for everyone from archetypal boffins in white coats to clinical trial-runners, business developers and communications officers. MedCity, which last year joined forces with promotional agency London and Partners, is presently working on input into the London Growth Plan, which is expected to be published later this year.